From the outside, content creators and bloggers have it MADE – thousands of fans, big name brand campaigns, huge influencer income – all from uploading videos of themselves applying makeup or playing video games. Right? Nope. YouTuber taxes can be pretty intense – to say nothing of Instagram taxes, TikTok taxes, fashion blogger taxes, and even, yes, Snapchat & Facebook taxes.

Make YouTube Your 9-5 Job: Join MagicLinks!

Influencer tax evasion is a serious issue, because income is income, according to the IRS. Report everything, or risk audit. Luckily, tax write offs for influencers abound.

How Do Influencers Pay Taxes, and What Influencer Tax Write Offs Are There?

What Tax Forms Do Influencers Need To Fill Out?

Independent influencers submit 1099 forms to every income source. For example, campaigns contracted directly between influencers and brands require 1099 submission from the influencer. Likewise, creators partnering directly with affiliate networks complete 1099 forms.

Pro Tip: As your channels grow, you can protect your liability by forming a corporation (inc) or LLC (limited liability corporation). LLCs and corporations follow corporate tax rules & file a Form 1120 each year.

How Are Influencers Taxed?

One point often overlooked by influencers is that they are, technically, self-employed. Therefore, social media influencers must pay self-employment taxes. If you work for a company and are not a 1099 contractor, for example, your employer pays half of your employment taxes. The remainder comes from your paychecks.

What does this mean for you? You’re paying ALL of your employment taxes. Ouch. For this reason, we recommend setting 30% of all influencer earnings aside for taxes. Self-employment taxes can be paid quarterly (4x a year) or annually (1x a year).

What Income Sources Do I Report on Influencer Taxes?

Even if your channels are not your full-time job, any income from your channels MUST be reported. These are the sources of income you must report on your social media taxes:

- Affiliate link commissions

- Ad revenue (i.e. Google Adsense payments from YouTube)

- Brand sponsorships

- Merch revenue

- Collaboration product earnings

- Products and travel gifted in exchange for promotional posts

Wait, Really? Do YouTubers Pay Taxes On Gifts? That’s Not Fair!

Yes: PR product gifting counts as income. This isn’t a new sweater from your grandma, after all, it’s a product given to you in exchange for promotion on your channel(s). Report any gifts you keep as income, totaling the full market price of the items. Gifts are not an influencer tax write-off.

What Tax Return Forms Do YouTubers and Influencers Get??

Any source that has paid you over $600 in one calendar year will send a Form 1099-NEC or Form 1099-MISC. The exception to this rule is for PayPal-issued payments (i.e. your MagicLinks commission payments). Only when you earn $20,000 or more and have received 200 or more PayPal payments in one calendar year from one employer or network will you receive a 1099 form.

Even if you do not receive a 1099 form from an employer or company, you must still report the income, along with the income source’s tax ID or social security number.

Influencer Tax Deductions (AKA Influencer Tax Write Offs, Cha-Ching!)

Sure, influencers get lots of perks, but content creation is expensive. You need to know your fashion blogger tax deductions, so you can save yourself some moolah. Like any other business, you can deduct:

Any expense considered “ordinary and necessary” for your job as a content creator is tax deductible. (Don’t get too deduction-happy, though – it’s an automatic IRS red flag!)

Do YouTubers Pay Taxes If It’s Not Their Full-Time Job?

Short answer: Yes. The IRS classifies any earned income as taxable. Even if Instagram, TikTok, or YouTube is currently your hobby or side gig, if you earn money from it, report it… Or else. No one wants to be on the IRS’s bad side!

Earn Money On YouTube: Join MagicLinks!

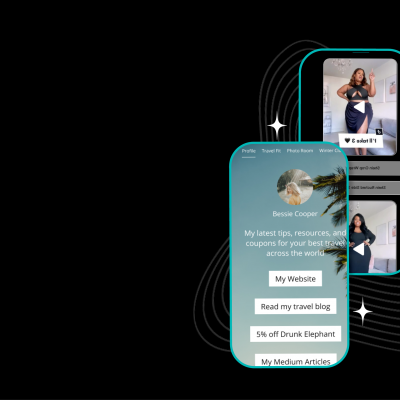

*Cover images courtesy of MagicLinks influencers Octavia B and Sadie Aldis

I love how this article is written like the entire world lives in the USA.

Hi CanadianTom – the bulk of our influencers live in the USA, but we’ll see what we can do about adding some information on foreign tax rules as well. Thank you for your feedback!